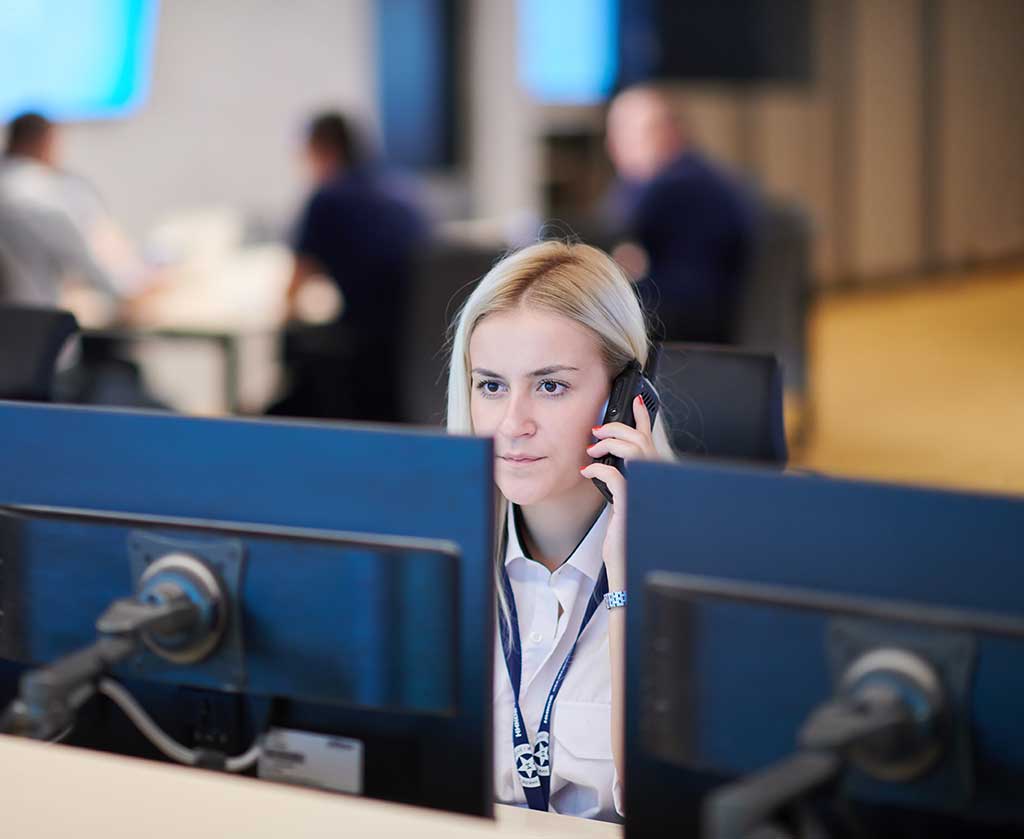

What Is Security Insurance?

Security insurance is a specialist form of protection designed to meet the needs of security firms and other professionals such as guards and door supervisors. Security business insurance is a flexible policy, and thanks to our close connections to a range of leading insurers, your local Coversure office can offer cover to:

- Mobile and static security guards

- Security firms

- Door supervisors/bouncers

- Close protection operatives

- Event security staff

- Site security staff

These are just some of the professions we can help. If you’d like to know more or discuss a specific issue, please contact your local Coversure. They’ll be able to offer you independent advice and offer you a security insurance quote.